At HOPE International, we believe it’s crucial to listen to our key stakeholders—clients, field partners, staff, and supporters—to understand their needs and respond well. In Burundi, both HOPE’s savings group program and microfinance institution, Turame Community Finance, have implemented new initiatives in 2018 to respond to client feedback and meet needs in new ways.

Tune your ears to wisdom, and concentrate on understanding.” Proverbs 2:2 (NLT)

A HOPE staff member trains other staff at Turame Community Finance

Serving low-literacy clients

In a country where nearly half of those living in rural areas qualify as illiterate, training is a challenge. Turame Community Finance, which serves both urban and rural communities, relies heavily on financial literacy and business training to equip and invest in their clients.

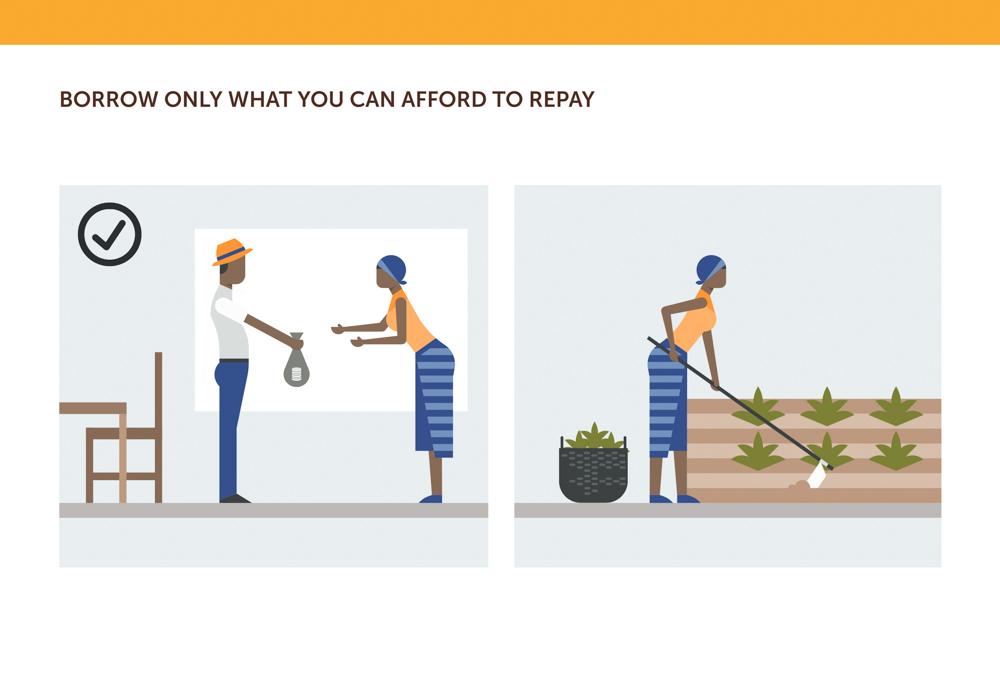

To specifically meet the needs of low-literacy clients, Turame piloted a new training tool in 2018: a flipbook. Adapted from curriculum developed by World Vision’s VisionFund, the flipbook (example on below) uses illustrations of a man and woman as they navigate decisions about borrowing wisely. Since launching in October 2018, 15 groups have completed the training pilot.

To specifically meet the needs of low-literacy clients, Turame piloted a new training tool in 2018: a flipbook. Adapted from curriculum developed by World Vision’s VisionFund, the flipbook (example on below) uses illustrations of a man and woman as they navigate decisions about borrowing wisely. Since launching in October 2018, 15 groups have completed the training pilot.

Training farmers

In Burundi, about 90% of the population lives off of the food they grow themselves—and since farming techniques are often passed down orally, many farmers haven’t had access to the latest best practices for maximizing their harvests. After hearing many savings groups request agricultural training, HOPE Burundi began piloting the Farming God’s Way program. Since launching in June 2018, 64 savings groups have participated in these trainings, learning about soil preservation and new fertilization, planting, and harvesting techniques.

In Burundi, about 90% of the population lives off of the food they grow themselves—and since farming techniques are often passed down orally, many farmers haven’t had access to the latest best practices for maximizing their harvests. After hearing many savings groups request agricultural training, HOPE Burundi began piloting the Farming God’s Way program. Since launching in June 2018, 64 savings groups have participated in these trainings, learning about soil preservation and new fertilization, planting, and harvesting techniques.

Learn more about HOPE’s work around the world in 2018! Our latest annual report is here.

Featured image: Esperance, a savings group member in Burundi

Sources: Global Partnership for Financial Inclusion (GPFI), Food and Agriculture Organization of the United Nations (FAO)